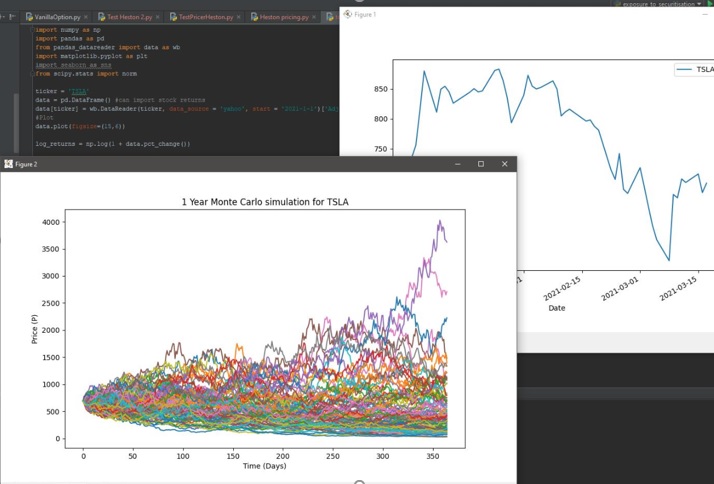

• Monte Carlo GBM stock price simulation (with web data reader): Here.

• Securitisation capital charge calculator (BIS d274) - source code: Here. Presentation: Here.

• Heston calibration using Quantlib: Here.

• Heston pricing using Quantlib and benchmarking against Black: Here.

• Heston volatility surface output: Here.

• Raspberry Pi Zero Stock-Crypto ticker project for a LED display: Here.

• More to come...

Excel and VBA is still the pillar in the investment banking / trading world, so you can find a lot of quantitative models tools implemented in this language. Of course Python today is the best way to go :).

• Portfolio stock price update based on ISIN: Here.

• Example of web crawler I made for a project: Here.

• QuantLib (old version) very helpful to implement library of useful functions in Excel: Here. QuantLib website: Here.

• Binomial tree option pricer that I used a very long time ago...: Here.

• Old Black Scholes option pricer that I developed a very long time ago...: Here. User guide (French): Here.

• Constant maturity swap (CMS) payoff replicated with swaptions (used long time ago): Here.

• Markowitz portfolio simulation tool (used long time ago): Here.

• SABR volatility simulaiton tool: Here.

• Interest rate cap and floor options calculated with SABR (Stochastic Alpha Beta Rho) volatility. An old university exercise project I worked on: Here.

• Newton–Raphson method simulation tools (old university exercises): Here and Here.